Membantu mewujudkan harapan

menjadi kenyataan.

A saving product with a predetermined time period without administration fee, free Life Insurance Protection* and features that can nurture customer’s disciplined saving habit for their future goals.

Mega Rencana is available in 2 choices:

*Please be advised that the catalog is subject to change without prior notice. Kindly reach out to your nearest Bank Mega branch for more detailed information.

| Information | Mega Rencana Reguler (IDR) | Mega Rencana Promo (IDR) |

|---|---|---|

| Initial Deposit | Minimal 100.000 | adjusted to the applicable Mega Rencana Promo scheme |

| Minimum Balance | 100.000 | 100.000 |

| Administration Fee (per Month) | Free | Free |

| Minimum Balance Fee (per Month) | - | - |

| Admin fee/ Withdrawal of Emergency Funds | 25.000 | N/A |

| Debit Failure Fee / Month | 5.000 | 50.000 |

| Dormant Fee (per Month) | - | - |

| Closing Account Fee | Free | Free |

| Closing Account Fee Before Due Date | 100.000 | 100,000 + Penalty according to product regulations |

| Monthly Deposit | Minimal 100.000 | adjusted to the applicable Mega Rencana Promo scheme |

|

Tier |

Balance Range |

Mega Rencana |

||

|---|---|---|---|---|

|

Reguler |

Promo |

|||

|

Product Code |

||||

|

Effective Until |

Effective Since |

Effective Since |

||

|

I |

< Minimum Balance |

0,00% |

0,00% |

0,00% |

| II | >= Minimum Balance | 2,00% | 1,00% | 0,50% |

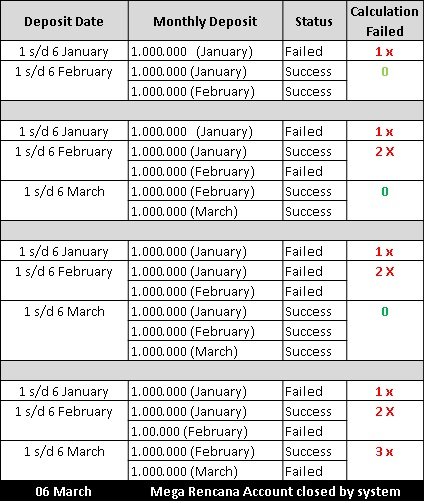

Illustration for the failed debit calculation:

Note:

Insurance policy in Mega Rencana saving is a product product of PT. Asuransi Simas Jiwa, PT. Bank Mega, Tbk (Bank) is not the guarantor of the insurance product and does not act as an agent or broker of the customer. The grant of life insurance benefits to Mega Rencana Customers is in the absolute authority of PT. Asuransi Simas Jiwa entirely.

Please fill the form below, we will contact you